A Level Economics Quiz 2020 Part 3

20 QuestionsQuiz Description

Economics is simply a subject that explains how economics work and how economic agents interact. Economics isn’t just a set of technical words; it’s actually using them to develop a viable business strategy.

Once you understand the terms, it’s easier to use theories and frameworks. In a way to help out students understand these theories, quizzes have been prepared for students/people going in for one or two different examinations. We have created a quiz of 20 questions which are questions from Advance level Economics 2020. We insist on the point that it is integral for you (students) to go through the quiz till the end. Some of these questions are found on the topics ``economic growth, tax, income and so on……”

Just trying this quiz gives you the satisfaction of knowing what you encounter ahead. So, we urge you to try more quizzes. You can also visit our website to gain more materials Good luck!!!

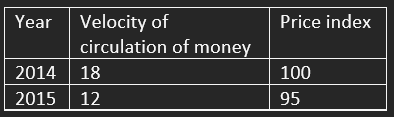

This question is based on the table below showing a partial accelerator table for an economy with a capital-output ratio of 2:1. Depreciation is constant at a rate of 1000 units of capital per year.

What is the most appropriate reason why replacement investment in year 5 is zero?

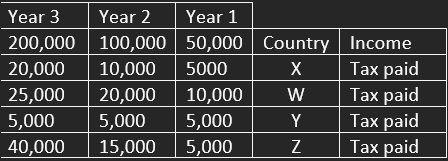

This question is based on the formula below:

(change in consumption)/(change in disposable income)

The formula above is used for calculating:

If C=70 million FCFA + 0.7Y, where Y is income which of the following will stand for the saving function?

If the income of an unskilled individual is 0 FCFA and his consumption is 1300 FCFA, what will this amount of consumption be referred to?

This question is based on the following formula:

1/(MPS)

The formula above seeks to calculate

To which group of customers below will BICEC bank Cameroon issue certificates of deposit?

A hypothetical commercial bank keeps 20,000 FCFA after receiving 200,000 FCFA as deposit from a customer. The maximum additional deposit created is:

This question

is based on the formula below:

(ED)/(ES+ED) x AMOUNT OF TAX,

Where ED is the elasticity of demand and ES is the elasticity of supply.

The formula above best calculates the:

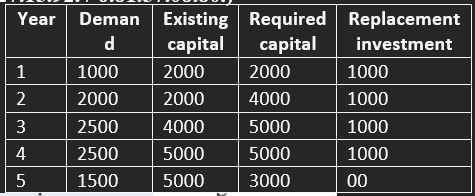

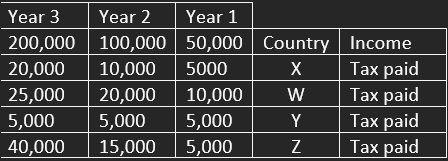

This question is based on the table below showing the tax structures in a number of countries.

In which of the above countries does the tax system respect the canon of vertical equity?

XYZ enterprise succeeds in transferring one quarter of its indirect tax to its

customers. This implies that the demand for the product is:

This question is based on the list below:

i. central government

ii. local governments

iii. public corporations

iv. public companies

the public sector consists of:

If countries have different opportunity cost ratios, and their international terms of

trade (TOT) lie within limits set by domestic opportunity cost ratios, the countries will find it:

Which of the following is an immediate and unavoidable result of devaluation other things being equal?

If short term measures fail to cure a country’s balance of payments deficit, the best possible thing to do is to:

Periodic fluctuations in economic activity most likely to reduce employment occur

during a:

A country’s labour force includes all those who are economically active. Economically active refers to those who are:

The removal of government regulation that restrict entry and exit of firms and competition is called: